By employing a strategic approach that considers the factors mentioned above, investors can navigate the complexities and capitalize on the potential Accounting for Technology Companies benefits of these investment vehicles. Remember, it’s essential to align investment choices with personal financial objectives and seek professional advice when necessary. Unless redeemed, issued perpetual preferred stock will thus pay dividends indefinitely, provided the issuer is still extant. Non-cumulative dividends give companies the chance to manage their cash flow better. They can skip dividend payouts in lean times without owing shareholders later on.

Disclosure of dividends in arrears on cumulative preferred stock

- They have worked with or on behalf of companies such as Google, Menlo Ventures, and Airbnb.

- Preferred stock dividends are sometimes considered qualified dividends for investors, who pay a lower rate of tax on this income than ordinary income.

- Convertible preferred stock gives shareholders the option to convert their shares into a specified number of common shares, adding a layer of diversification to this asset class.

- These financial instruments offer a fixed dividend rate and have priority over common stock in dividend payments and asset liquidation.

- But this can be a tax benefit depending on the investor’s jurisdiction, the holding period, and other tax circumstances.

- Companies issuing this type of stock often adopt flexible dividend policies, allowing them to adjust or even skip dividend payments without the obligation to compensate for missed payments in the future.

For companies, choosing between cumulative and non-cumulative preferred stock impacts their balance sheet and obligations to shareholders, influencing their overall equity structure and ownership distribution. Preferred stock often provides more stability and cash flow compared to common stock. Therefore, investors looking to hold equities but not overexpose their portfolio to risk often buy preferred stock. The company issuing the preferred stock does not receive a tax advantage, however. Institutional investors and large firms may be enticed to the investment due to its tax advantages. For example, let’s say you own 100 shares of non-cumulative preferred stock in Company X, which has an annual dividend rate of $2 per share.

Dividend and Payment

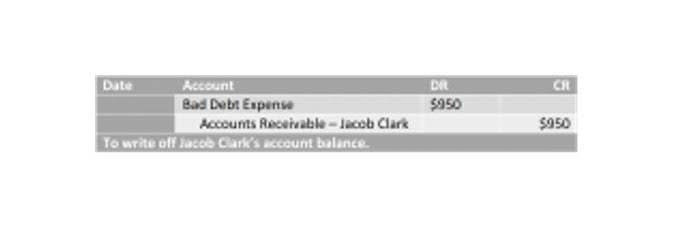

Unlike cumulative preferred stock, noncumulative preferred stock does not utilize the dividend in arrears account for unpaid dividends. Noncumulative preferred stockholders have priority over common shareholders recording transactions when it comes to dividends that are declared in the current year. All preferred dividends must be paid first, but if no dividends are declared, the noncumulative preferred shareholders don’t get a dividend that year. For instance, consider a utility company, UtilityCo, that issues cumulative preferred stock with a 5% dividend rate. This backlog of dividends must be cleared before any dividends can be distributed to common shareholders, ensuring that the cumulative preferred shareholders are compensated for their patience and risk. From an investor’s perspective, non-cumulative preferred stock can be less attractive than its cumulative counterpart because of the dividend risk.

- Having this type of flexibility is crucial for keeping cash flow during difficult times.

- Qualified Dividend Income (QDI)Dividend income is usually taxed as per one’s income tax rate.

- Limited reinvestment opportunities are another drawback, as companies may be forced to distribute cumulative dividends instead of reinvesting profits into the business.

- On the other hand, cumulative dividends promise payment eventually, giving them peace of mind.

- Preferred stock is an essential tool for companies looking to raise capital without diluting their ownership stakes significantly.

- Depending on where you live and the tax laws in place, dividends from preferred shares may be taxed at a lower rate than ordinary income in some cases.

Understanding Cumulative Preferred Stock: Benefits and Risks

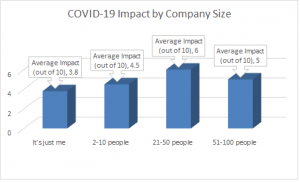

If a company decides not to pay dividends in a given period, shareholders of non-cumulative preferred stock forfeit their right to those missed payments. This feature can be particularly advantageous for companies facing financial difficulties, as it provides them with greater flexibility in managing cash flow without the burden of accruing dividend arrears. Investors may shy away from non-cumulative preferred stock due to the lack of a guarantee for missed dividends, which can create uncertainty and discourage long-term investment. Conflicts between shareholders and management may arise when deciding on dividend payments as non-cumulative preferred stockholders do not have the same rights as cumulative preferred stockholders. The inability to accumulate missed dividends can lead to financial constraints for companies, limiting their flexibility in managing equity and debt financing strategies in corporate finance.

In any case, understanding the cross-asset correlation profile of an exposure prior to implementation should be on the investor’s portfolio construction checklist. For preferreds, as they are both bond-and stock-like, their correlation profile noncumulative preferred stock is low relative to both asset classes, as shown below. Let’s assume a company issued $1 million dollars in participating preferred stock that was capped at a 2X participation, and that the stock represented 10% of the company.

Issuers

They offer a fixed rate of return, which is typically higher than the rate offered by traditional debt securities. Through an online broker or by contacting your personal broker at a full-service brokerage. Their dividends come from the company’s after-tax profits and are taxable to the shareholder (unless held in a tax-advantaged account). Despite its benefits, Non Cumulative Preferred Stock presents companies with challenges such as limited investor appeal, potential conflicts over dividend policies, and constraints on financial decision-making.

Preferred Securities are subordinated to bonds and other debt instruments, and will be subject to greater credit risk. The municipal market can be affected by adverse tax, legislative or political changes and the financial condition of the issuers of municipal securities. The fund may contain interest rate risk (as interest rates rise bond prices usually fall); the risk of issuer default; inflation risk; and issuer call risk. The Fund may invest in US dollar-denominated securities of foreign issuers traded in the United States.

- The risk of not receiving a dividend in any given year may deter potential investors, which could lead to a lower demand and consequently a lower price for the stock.

- Cumulative preferred stocks get their name from the fact that their owners will receive all pending dividend payments.

- Conversely, in a rising interest rate environment, the fixed dividend payments of non-cumulative preferreds may become less attractive compared to other investment options, leading to shifts in investor preferences.

- After two years, the company’s financial position has improved enough that it’s able to restart dividend payments.

- As a result, ABC Corporation was unable to fulfill its obligation of paying dividends to its preferred shareholders.

- The term “noncumulative” describes a type of preferred stock that does not pay stockholders any unpaid or omitted dividends.

While non-cumulative preferred stocks can offer higher yields, they come with the risk of lost income during dividend suspensions, which must be carefully considered against the potential rewards. Non-cumulative preferred stock represents a type of ownership that carries a fixed dividend which, if omitted, does not accumulate for future payment. This financial instrument offers unique advantages for both the issuing company and the investor.

Technically, they are equity securities, but they share many characteristics with debt instruments. Yes, choosing between the two can impact your returns since one pays missed amounts and the other doesn’t. Cumulative dividends build up if missed and must be paid out before new dividends are given. – Can discourage aggressive investment strategies due to the need to prioritize dividends. – Allows for strategic allocation of profits to other company initiatives or investments. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.